Multifamily Investment updates (DFW)– Oct 2024

GREA has been one of my favorite commercial brokerage firms in the Dallas Fort Worth (DFW) area, and I felt honored to be invited to their annual conference to learn about their latest analysis for the DFW multifamily market. In this article I’d like to share some of the most interesting insights that I learnt during this event.

1) In Post Covid era (2022-2024), occupancy went down 4.8% and rent went up 1.8%. However, the good news is overall average occupancy rate in DFW is still above 90%. Below illustrates the occupancy rate and rent trends by subdivisions. As you can tell, occupancy and rents in most areas drop (red), although some upward trends in rents offset the rent drop in the whole market.

2) It cost 48% more to own a home than to rent a home in DFW market. Let’s do some number crunching here. 80% of homeowners have a mortgage rate of 4% or less, which implies the inventory for sale would rather be limited. Average price of a home in DFW is $400k, and average down payment for first-time buyer is only 8%. If we do a calculation, the average mortgage of a homeowner is about $2227.68 / month. We add average taxes ($766.67 / month), average insurances ($364.42 / month), average repair & maintenance cost ($333.33 / month) all together, and we get the total monthly cost of an average home in DFW to be $3692.10, which is 48% higher than the average rent in DFW ($1907).

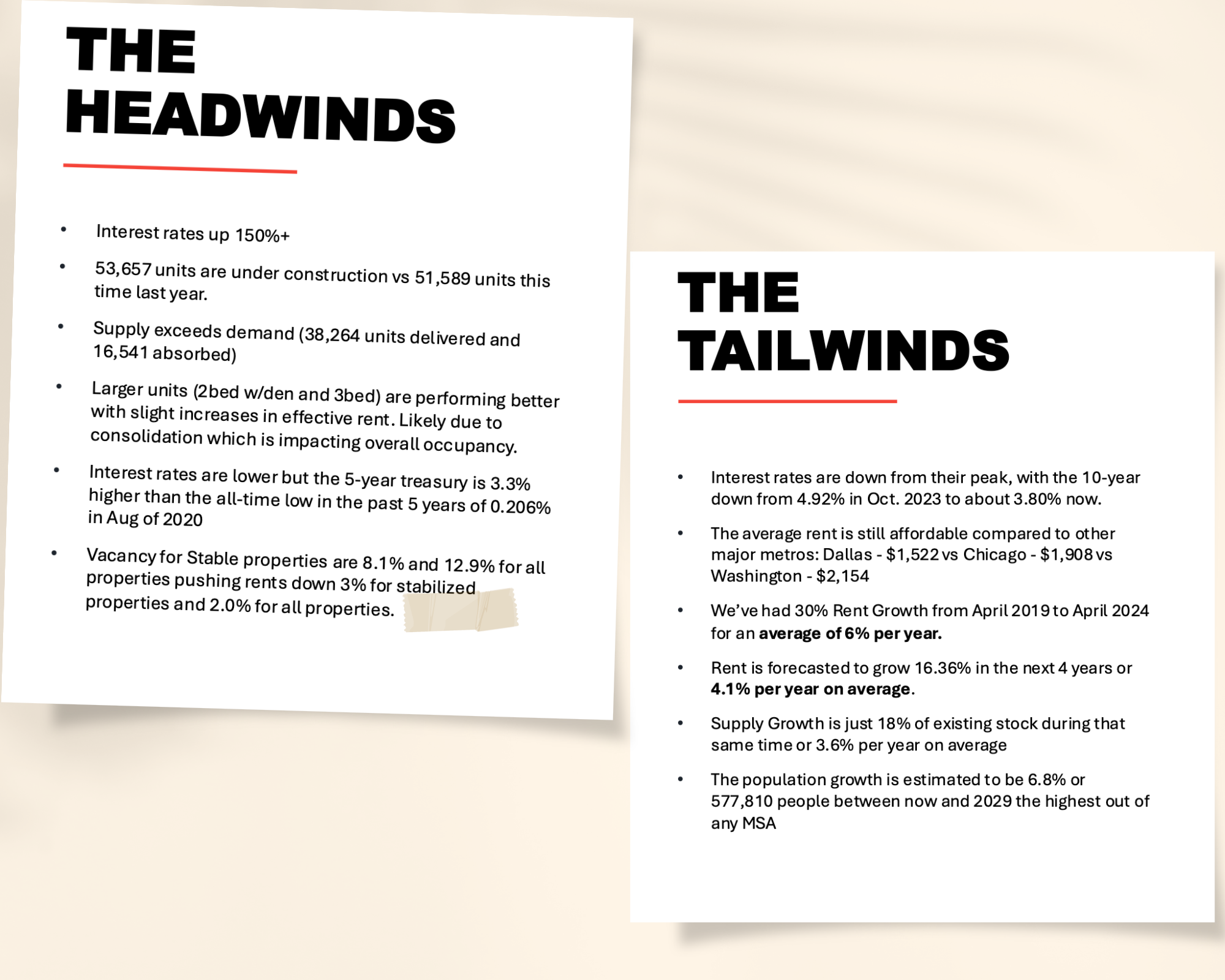

3) The headwinds and tailwinds for DFW multifamily. See the summary below for the opportunities and challenges we face in DFW multifamily.

Some highlights:

There are currently more supplies than demands due to excessive construction. It may take a few years to absorb these excessive newly built units. This may put pressure on Class A properties due to competition for Class A tenants.

However, in the longer run, DFW fundamentals look good in terms of population growth (6.8%) and job growth (4.4%) between now and 2029, best out of any US Metro areas. Market is expected to stabilize in 2026 and absorb nearly all multifamily units.

As we all know, Federal interest rate dropped very recently. However, treasury doesn’t necessarily correlate. It will still take some time to see how this interest rate thing pans out in the future months.

Rents are forecasted to grow 4.1% per year on average in the next 4 years.

4) Multifamily sales in DFW in 2024

Sales are down but starting to trend up with a 57% increase in transactions from 2024 Q1 to Q3, with more properties hitting the market.

There were 188 properties listed YTD, with 163 of those listed in the first half and only 88 properties closed, or 54%. That is from 45% in 2023.

There have been 121 total closings YTD, which means 33 properties sold off-market or 27%

If YTD trends keep up, we will be down 59.5% from our peak number of units sold in 2021 (91,389 vs 37,006)

Cap Rates are decompressed with Class-A between 4.7% and 5%, Class-B around 5.5%, and Class-C 6%+

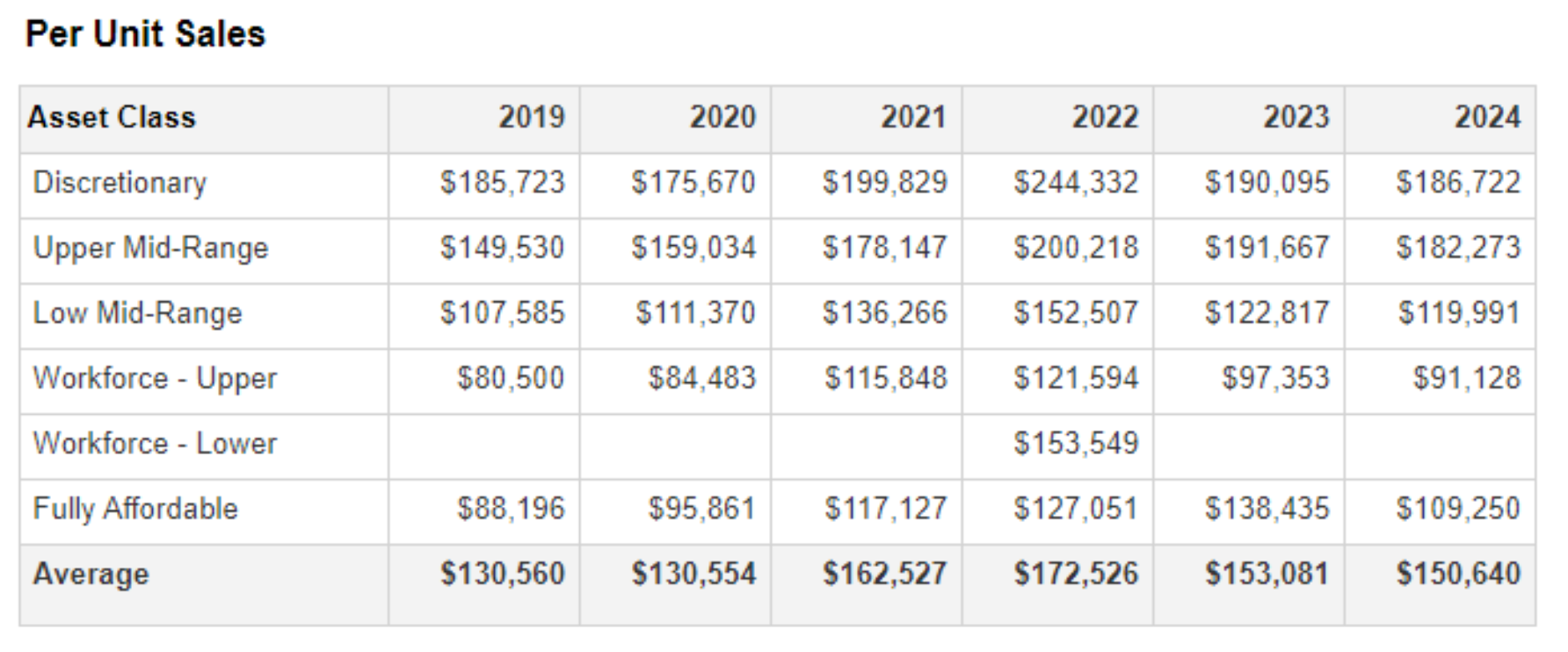

Valuations are down 20%+/- but the average sales price per unit is only down 12.7% from 2022 due to low transaction volume and the scarcity premium properties are fetching.

Below is the sales price per unit in DFW 2024.

5) Highlights from the panelists’ discussion points:

Institutional Capital are sitting on the side line right now, and retail investors are waiting for institutions to act.

Bank are incredibly flexible and willing to help distressed multifamily operators to survive.

Agency loans are harder to get. It takes longer, requires more inspections, etc because there were some fraud in the past and they are trying to do more due diligence.

Section 8 subsidized properties are in favor now because rents are guaranteed; we may have some challenges getting rents from tenants.

Class A / A- properties are seen at bottoms, since there are more listings and competitions right now. But for class B / C properties, not sure if we are going to see any bottom pricing at all.

Taxes are seen going down; insurances went over the roof in the past few years, but it’s staying flat in 2024, and are expected to go down.

Operators are putting minimums in renovations, and vendors are actively looking for work. A sign of tighter budget.

One of the highest priorities of operators now are focusing on retention instead of getting new tenants.